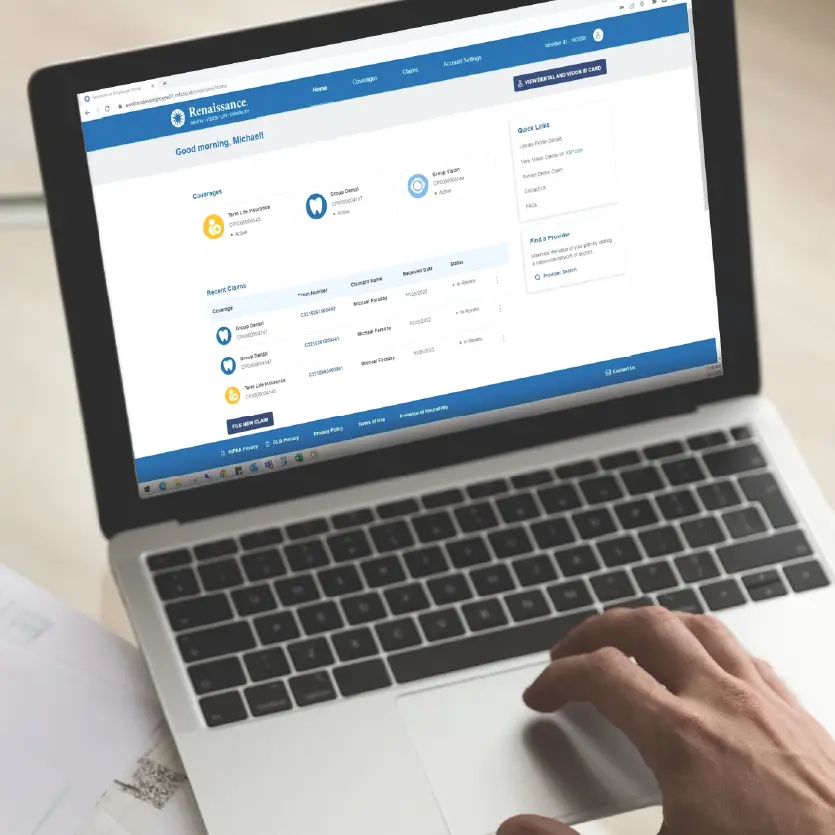

Get Extra Protection with RenSecureHealth Supplemental Health Insurance

If your employer offers RenSecureHealth, you have access to valuable supplemental health insurance that can help provide financial assistance for unexpected medical expenses, when you need it most.

RenSecureHealth works alongside your primary health insurance to provide an extra layer of financial support. If you experience a covered injury or illness, the plan pays a cash benefit based on the initial diagnosis, regardless of whether you are hospitalized. You can use this money to help cover copayments, deductibles, non-covered treatments or any other expenses you may incur.

Wondering if you need this additional coverage? Even with health insurance, unforeseen medical events can lead to significant out-of-pocket costs. With Supplemental Health insurance, you can focus on your recovery without worrying about the financial burden of medical expenses. The plan provides:

- 24/7 coverage

- Cash benefits to help cover out-of-pocket costs

- Peace of mind knowing you have additional financial protection

- Flexible coverage options to meet your individual needs

Supplemental Health Insurance Plans for You and Your Family

RenSecureHealth covers a wide range of conditions, from minor injuries to serious illnesses. The plan offers three levels of coverage to ensure you’re protected when life takes an unexpected turn.